|

Barrie Office Hours:

Due to a robbery that has resulted in a staff shortage, the office

continues with reduced hours until further notice. We regret the

inconvenience. The Barrie office is open:

Tuesdays and Fridays 9:30 a.m.-4:00 p.m.

Appointments can be made during and outside of these times.

Our Mississauga office is open Monday-Friday 9am-5pm. Inquiries can

be made directly to our Mississauga office @1-800-463-3602.

Messages left at the Barrie branch (705-737-5622) are retrieved

daily and will be returned regularly.

We will update this site with further details as they are available.

Your patience, understanding and support for our staff is greatly

appreciated.

For no charge atm transactions please reference the following link

for a location near to you.

https://www.theexchangenetwork.ca/Find-An-ATM.aspx

TRAVEL ALERT

Financial Institution are facing an alarming number of attempted

cyber attacks.

To mitigate this potential risk to OECU and its members, we have

chosen to block several countries, which disables access to internet

banking.

If you are travelling outside of Canada and the United States,

please be advised that you will not have access to internet

banking. Talk to your Member Service Rep for solutions during

your travels.

We understand that this is an inconvenience, but we remain committed

to taking whatever action is necessary to protect our members.

COVID-19 and Your Credit

Union.

The continued spread of Coronavirus (COVID-19) and its variants in

Canada and around the world continues to be the primary concern for

you and your family. At OECU the well-being of our member/owners and

employees is of the deepest concern to us. We want you to know that

your safety and our employee’s safety will remain our top priority

as this situation continues to evolve.

Read more >>

Is being the Chief

Financial Officer of your home stressing you out?

Let us help you De-Stress your Finances and get you out of debt

sooner with a manageable, lower interest, debt consolidation payment

that is right for you …

Unsecured Personal Loan

starting as low as … 7.99%*

“Hard sell & up sell”

practices in the financial world!

The concept of a “Sales Culture” has been around for

a very long time. It is not something that our Board of Directors or

I have embraced as the business model for our organization. We

instead focus on providing exceptional service!

Read more...

Call for Nominations!

It is our desire to have a diverse Board of Directors that is a

reflection of our Membership.

We are searching for candidates that have a passion to make our

Credit Union better today and tomorrow.

If you are interested in information about being a Director of OECU

please click on the link “Cover

Info for Potential Candidates.”

For additional information and an application form please click on

the link “OECU

Candidate for Director”

Thank you for your interest.

Cover Info for Potential Candidates |

OECU Candidate for Director

Off my pay... Off my mind

Start Saving Today…

click here for details.

Travel Alert – Country Blocking

If you are travelling out of North America please

read this

document for important information.

ATM Card Cancellation

If your ATM (Membercard) is Lost, Stolen, Compromised (skimmed) or

even if you just have a sense that your card may have been

compromised call one of the numbers below and cancel your card

immediately. This interactive voice response service is available 24

hours a day seven days a week.

Cancel your card via any of the following

options:

ü

Birth date and social insurance number.

ü

Account number and social insurance number.

ü

Name and social insurance number.

ü

Name and account number.

ü

ATM (Membercard) number.

Stop the criminals from stealing your hard

earned money, if you have any suspicious Automated Teller Machine or

Point of Sale transactions; cancel you ATM card immediately by

calling…

Ø

877 – 764 – 3693 (Canada & U.S.)

Ø

905 – 764 – 3693 (International)

Who can do business with OECU?

All

educational employees (current or retired) and their families

throughout Ontario can do business with us – Your Full Service

Financial Institution. We are the financial institution dedicated

to, and specializing in serving the unique needs of the educational

community. All

educational employees (current or retired) and their families

throughout Ontario can do business with us – Your Full Service

Financial Institution. We are the financial institution dedicated

to, and specializing in serving the unique needs of the educational

community.

Read about this and other FAQ's of OECU in the

Spring Newsletter.

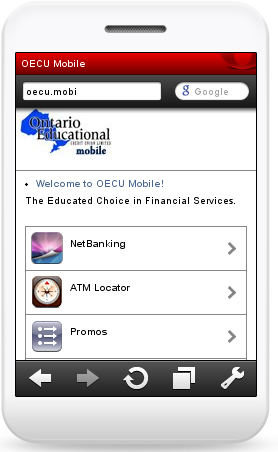

OECU Mobile...is here!

OECU has a new, Mobile web site. We're excited to offer

Members access to many of the features of our main site on a

handheld device. Features that are currently available on our Mobile

site, include: NetBanking, ATM Locator, Promos, News, Services,

Rates and a Contact page with office maps.

To access the OECU mobile web site, enter oecu.mobi into the

web address bar on your smart phone or mobile device.

Note: Visiting the OECU mobile web site (oecu.mobi) on a

computer will automatically re-direct you to our main web site

(oecu.on.ca).

Mutual Funds

For a diverse

investment plan

Mutual funds combine the benefits of diversification and

professional asset management with affordability – making them an

ideal solution for many investors.

Our seasoned Credential Asset Management Inc. Wealth Consultants have access to thousands of quality

mutual funds from top performing fund families like:

-

NEI

-

AGF

-

Franklin Templeton

-

Mackenzie

-

Fidelity

Together, they’ll work with you to understand your overall

investment strategy and make recommendations on the right mix of

mutual funds for your financial goals.

Talk to a Wealth Consultant today to find out if mutual funds are

right for you.

Mutual funds and other securities are offered through

Aviso Wealth, a division of Aviso Financial Inc.

Commissions, trailing commissions, management fees and expenses all

may be associated with mutual fund investments. Please read the

prospectus before investing. Unless otherwise stated, mutual fund

securities and cash balances are not insured nor guaranteed, their

values change frequently and past performance may not be repeated.

Aviso Financial Inc. and Northwest & Ethical

Investments L.P. are all wholly owned subsidiaries of Aviso Wealth

Inc.

GO

Figure - Your ABC’s of Personal Finance

With

one stop, make more informed financial decisions, organize your

finances and calculate your needs for mortgages, personal & auto

loans, retirement,

and much more! “Go

Figure”. With

one stop, make more informed financial decisions, organize your

finances and calculate your needs for mortgages, personal & auto

loans, retirement,

and much more! “Go

Figure”.

|